when will i get my minnesota unemployment tax refund

HUNDREDS of thousands of households in Minnesota will get tax refunds worth an average of 584 each by New Years Eve. PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks the Minnesota Department of Revenue said Thursday after the legislature signed off on a tax relief package before ending their work.

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including.

. About 500000 Minnesotans are in line to. The unemployment tax seems quite strange to many people. On september 13th the state of minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

Because of one word Minnesota cant issue refunds for overpaid unemployment tax Businesses can still receive credits if they paid a higher rate on unemployment taxes. How can I check what my adjusted gross income was for tax years 2020 and 2021. You can call the agency at 800-829-1040 or you can use the IRSs Wheres My Refund tool to check up on the status of your refund.

Tim Walz signed Frontline Worker Payments into law April 29 2022 enabling those workers to apply for Frontline Worker Pay. MyIdea I Havent Received My Unemployment Tax Refund 2021. Some of the information on the following FAQ pages may be outdated due to Minnesota tax law changes enacted July 1 2021.

Law Change FAQs for Businesses 2017-19 updated 10032019. Keep in mind that if you filed a paper return your refund may be delayed. The amount of the refund will vary per person depending on overall income tax bracket and how.

Mail to Minnesota employers on or before December 15 2021. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the. But a lot of people still.

Were reviewing this content. The Minnesota Department of Revenue is issuing the checks for taxpayers who paid state tax on unemployment benefits. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. Direct Deposit Limits We only deposit up to five Minnesota income tax refunds and five property tax refunds into a single bank account. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill.

The amount of tax reduction available to an eligible employer between july 1 2016 and june 30 2017 will be a dollar amount equal to the ratio of taxes they paid in 2015 to the. They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while. How to calculate your unemployment benefits tax refund.

For details see Direct Deposit. The website also states that they sent letters to taxpayers that need to amend their state return. Additional Assessment for 2022 from 1400 to 000.

These payments are typically based on time in service andor job performance and as such are taxable as wages. Mail your property tax refund return to. If you enter an account that exceeds this limit well send your refund as a paper check.

The handle is not the result of any errors or issues with your return. The new law reduces the. Meanwhile households who receive the cash refund by paper check could expect this from July 16.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. The Taxable wage base for 2022 is 38000. Another batch of payments were then sent out at the end of July with direct deposits on July 28 and paper checks on July 30.

If you received unemployment benefits in 2020 a tax refund may be on its way to you Severance pay is a lump-sum payment received from a company when you are terminated due to job closings company reductions or even company closures. Tax refund time frames will vary. Were reviewing this content.

FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. Quarterly wage detail reports and payments must be received by the department on or before the due date. This process is expected to be finished in early 2022 meaning some will have to wait until next year to get a refund.

Base Tax Rate for 2022 from 050 to 010. Significant non-submission fees will be assessed for late reports and payments. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

Due dates are the last day of the month following the end of the calendar quarter. The first refunds for 2020 will not be available in taxpayer bank accounts until the first week of March. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. How do I know if I received more than 20 weeks of unemployment. It is too late to change your address for the 1099-G mailing but you can access your 1099-G online.

Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. Applications will open Wednesday June 8 2022 at 8 am. In mid-July the IRS issued 4million refunds of which those by direct deposit landed in bank accounts from July 14.

If you received an unemployment benefit payment at any point in 2021 we will provide you a tax document called the 1099-G. When will I get the refund. About 500000 Minnesotans are in line to get.

You can access your unemployment insurance benefit history by following the instructions located on the Minnesota Unemployment Insurances Print payment history webpage. Mn unemployment tax refund when will i get it. CTAbout Frontline Worker PayTo thank those Minnesotans who worked on the frontlines during the COVID-19 peacetime emergency Gov.

If youre expecting a refund on unemployment income but you dont receive one contact the IRS and inquire about it. 4th Quarter October 1 - December 31 January 31. Application dates are June 8 through.

If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic. Unemployment benefits are taxable under both federal and Minnesota law. Although some states add state taxes to the benefits Minnesota issued a tax exemption just as.

Do not be concerned if the hold is because you filed before mid-February.

Where S My Refund Minnesota H R Block

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

When Will Irs Send Unemployment Tax Refunds Kare11 Com

Questions About The Unemployment Tax Refund R Irs

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Mn Unemployed Freelancers And Self Employed Facebook

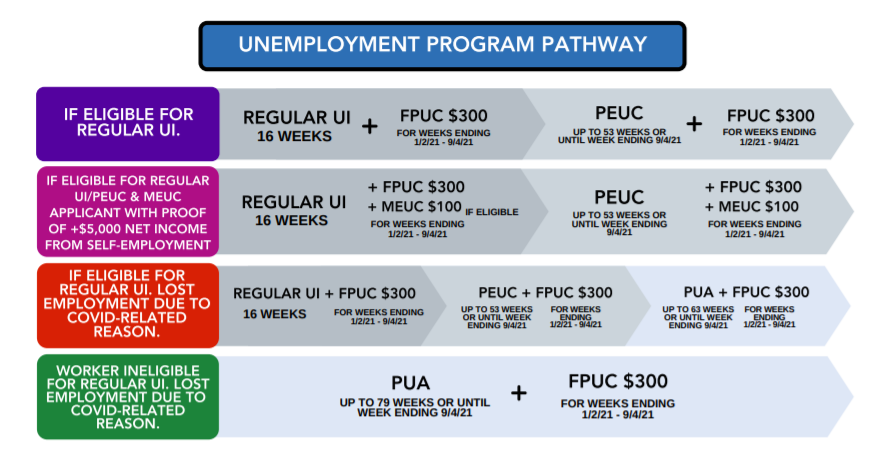

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

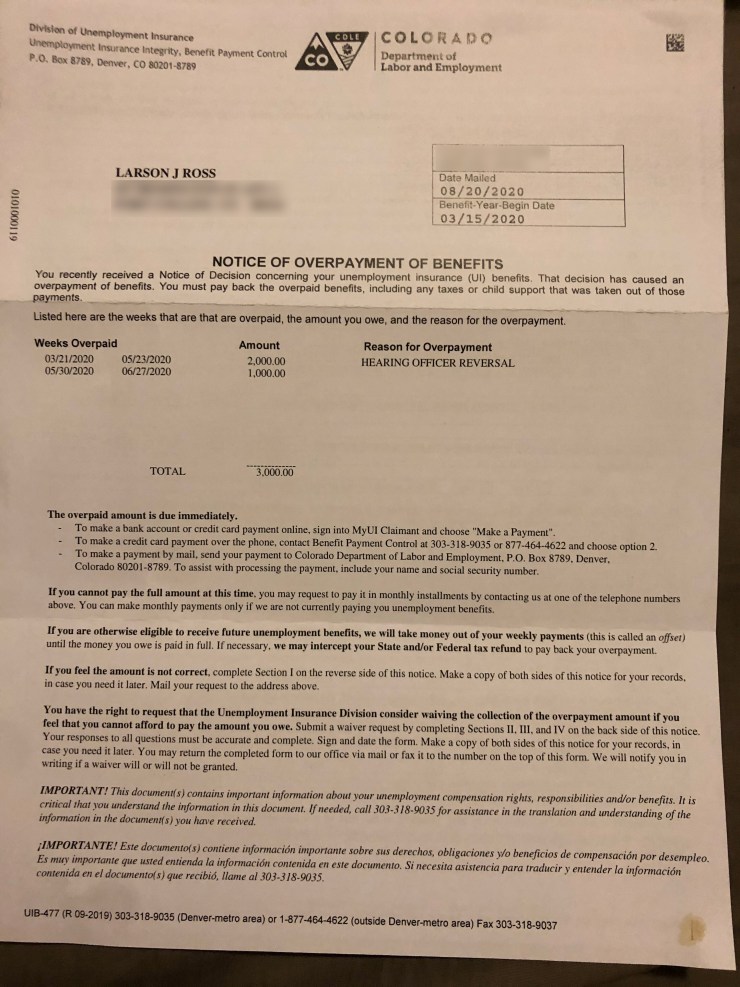

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

State Income Tax Returns And Unemployment Compensation

Mn Unemployed Freelancers And Self Employed Facebook

When Should Minnesotans Expect Tax Refunds Passed In The State Budget Star Tribune

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities